Europe Digital Lending Platform Market Production, Demand, and Business Projections 2029

Introduction

The Europe Digital Lending Platform Market consists of software-driven systems that automate, manage, and streamline the lending process for banks, financial institutions, fintech companies, and alternative lenders. These platforms support loan origination, credit scoring, underwriting, documentation, disbursement, and repayment management through digital interfaces. They improve operational efficiency and offer faster loan approvals through digital workflows and data analytics.

Digital lending holds significant importance in the global financial ecosystem. Europe plays a strong role due to its advanced banking infrastructure, regulatory modernization, and high digital adoption rates. The region’s focus on financial inclusion, open banking reforms, and fintech innovation drives the shift from traditional lending models to technology-enabled platforms.

The Europe Digital Lending Platform Market is valued at an estimated USD 6–7 billion in 2025. Digital transformation initiatives across the banking and financial services sector continue to reinforce the relevance of lending automation. The expansion of small business financing, consumer credit, and digital banking services strengthens the role of digital lending platforms across Europe.

Learn how the Europe Digital Lending Platform Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/europe-digital-lending-platform-market

The Evolution

The market’s evolution reflects major shifts in European finance, technology, and consumer behavior. Early digital lending tools emerged as simple loan management dashboards used primarily by large banks. Growth accelerated as cloud computing, data analytics, and mobile banking gained adoption. Fintech lenders introduced fully automated loan applications, enabling faster approvals and improved user experience.

Key milestones include the introduction of electronic know-your-customer (e-KYC) processes, AI-driven credit scoring models, and open banking standards under PSD2 regulations. These innovations improved data access, enhanced risk assessment, and increased transparency. Automation replaced paper-based processes and reduced turnaround times from days to minutes.

Demand patterns shifted as consumers and small businesses favored digital channels, particularly during global disruptions that limited physical access to bank branches. European governments adopted digital policies to support fintech collaborations, cross-border banking, and financial inclusion. The rise of embedded finance created demand for lending functionality integrated into retail, transportation, and e-commerce platforms.

Market Trends

Several trends define the current trajectory of the Europe Digital Lending Platform Market.

AI-enabled risk assessment is becoming central. Lenders are using machine learning models to analyze alternative data such as transaction history, digital behavior, and business cash flow. These tools improve credit evaluation accuracy and expand lending to underserved segments.

Cloud-based lending infrastructure is increasing in adoption. Banks and fintechs prefer cloud platforms for scalability, lower IT costs, and integrated security features. Cloud solutions enable faster deployment and flexible product customization.

Embedded lending is gaining traction across retail and trade sectors. Companies integrate financing options directly into their digital platforms, creating instant loan offerings at the point of sale.

Automation tools such as robotic process automation (RPA), digital signatures, and document recognition technologies are transforming backend operations. These tools reduce manual interventions and improve loan processing speed.

Regional adoption patterns show strong growth in Western Europe, driven by mature financial markets and supportive regulatory frameworks. Central and Eastern Europe are expanding digital credit through fintech adoption and increasing smartphone penetration.

Sustainability lending tools are emerging. Banks offer green loans and sustainable finance products supported by digital monitoring systems that track environmental impact metrics.

Challenges

The Europe Digital Lending Platform Market faces a variety of structural and regulatory challenges.

Regulatory variations across European countries create complexities for cross-border lending. Compliance with data protection regulations such as GDPR increases operational responsibilities for lenders.

Economic uncertainties influence loan demand and repayment behavior. Inflation, interest rate fluctuations, and credit market instability affect risk management. Lenders must balance automation with prudent underwriting practices.

Cybersecurity threats present serious risks. Digital lending platforms handle sensitive financial and personal data, making them targets for cyberattacks. Security breaches can lead to financial losses and reputational damage.

Legacy banking infrastructure limits integration capabilities. Many traditional banks face challenges transitioning from outdated systems to modern digital platforms. This slows digital adoption and increases implementation costs.

Market growth is restrained by consumer trust concerns in certain regions, especially among older populations accustomed to in-person banking. Limited digital literacy creates adoption barriers in rural areas.

Supply chain disruptions in software development, hardware procurement, and IT services can impact the deployment of digital lending solutions. Vendor dependency creates operational vulnerabilities for financial institutions.

Market Scope

The Europe Digital Lending Platform Market covers a broad range of product categories, deployment models, and end-use applications.

Segmentation by Type

-

Loan origination platforms

-

Loan management platforms

-

Risk and compliance management tools

-

Digital onboarding solutions

-

Credit scoring and analytics systems

-

Documentation and e-signature platforms

-

Collections and repayment management tools

Segmentation by Application

-

Personal loans

-

Small and medium enterprise loans

-

Mortgage loans

-

Auto loans

-

Point-of-sale financing

-

Education loans

-

Peer-to-peer lending

Segmentation by Technology

-

Artificial intelligence

-

Machine learning

-

Blockchain

-

Cloud computing

-

API-based integrations

-

Robotic process automation

-

Data analytics

Regional Analysis

-

North America: Mature digital lending ecosystem influencing global best practices.

-

Europe: Strong regulatory support, high fintech adoption, expanding cloud infrastructure.

-

Asia-Pacific: Fast adoption driven by mobile finance, digital wallets, and large fintech ecosystems.

-

Latin America: Growing digital credit solutions for unbanked populations.

-

Middle East & Africa: Increasing digital lending activity supported by mobile banking penetration.

End-User Industries

-

Banking and financial services

-

Fintech companies

-

E-commerce platforms

-

Automotive financing

-

Real estate and mortgage services

-

Education financing providers

-

Insurance companies

-

Government agencies

Market Size and Factors Driving Growth

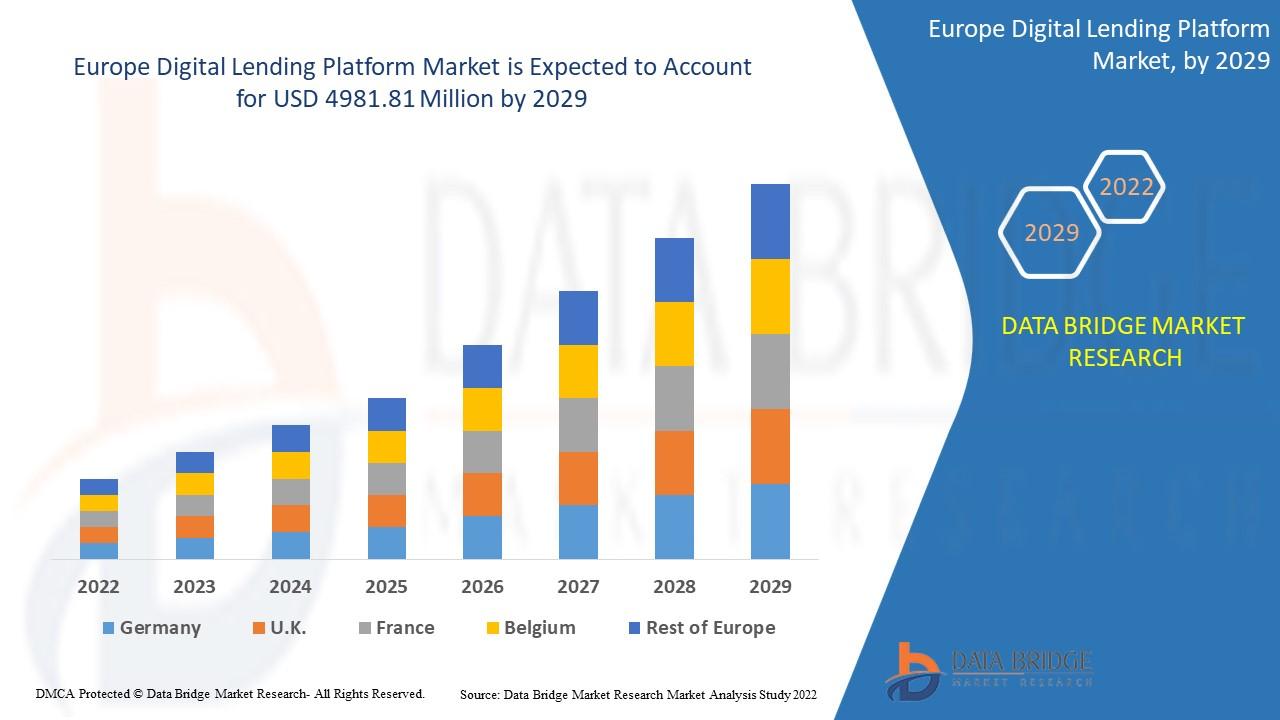

Europe digital lending platform market was valued at USD 1238.83 million in 2021 and is expected to reach USD 4981.81 million by 2029, registering a CAGR of 19.00% during the forecast period of 2022-2029.

Multiple factors drive this growth.

Technology modernization across Europe accelerates the shift from traditional lending to digital systems. AI, cloud computing, and open banking technologies enhance lending efficiency and create new revenue opportunities.

Rising digital banking adoption supports the growth of digital lending. Large and mid-sized banks partner with fintech solution providers to improve customer experience and reduce operational costs. Mobile-first consumers prefer digital loan applications and instant approvals.

Government policies play a strong role. PSD2, digital identity programs, and financial inclusion initiatives support innovation. These policies provide clarity for fintech operations and promote competition across the lending ecosystem.

Population trends influence credit demand. Younger demographics prefer online and app-based borrowing. Small and medium enterprises rely on digital lending platforms for quick access to working capital.

Sustainability and green finance initiatives increase demand for specialized lending platforms that track compliance with environmental standards.

Opportunities are strong in Central and Eastern Europe as these regions expand digital infrastructure and adopt mobile financial services. Embedded lending solutions in retail, logistics, and travel industries create additional growth channels.

Conclusion

The Europe Digital Lending Platform Market presents strong growth opportunities through 2035. Advancements in artificial intelligence, cloud computing, and open banking continue to transform lending services. Digital lending platforms enhance operational efficiency, expand financial access, and support faster loan processing.

Innovation, cybersecurity enhancement, and regulatory alignment will determine the future success of market participants. Lenders and fintech companies that invest in advanced analytics, automated decision-making, and customer-centric platforms will gain significant competitive advantages. The increasing integration of digital lending into retail and commercial sectors reinforces the long-term growth potential of this market.

Frequently Asked Questions (FAQ)

1. What is a digital lending platform?

A digital lending platform automates loan origination, underwriting, disbursement, and repayment using software and digital analytics tools.

2. What drives the Europe Digital Lending Platform Market?

Technology modernization, open banking regulations, fintech growth, and consumer preference for digital banking.

3. Which technologies are widely used?

Artificial intelligence, machine learning, data analytics, cloud computing, API integrations, blockchain, and robotic process automation.

4. Which loan categories benefit most from digital lending?

Personal loans, SME loans, mortgages, auto loans, and embedded consumer finance.

5. What challenges affect market growth?

Regulatory complexity, cybersecurity risks, legacy IT systems, and consumer trust concerns.

6. What is the expected CAGR through 2035?

The market is projected to grow at a CAGR of 9–11 percent.

7. Which industries use digital lending platforms?

Banks, fintech companies, e-commerce firms, auto finance providers, mortgage lenders, insurers, and government programs.

Browse More Reports:

Global Electrotherapy Market

Global Email Hosting Services Market

Global Hypercholesterolemia Treatment Market

Global Hyperloop Technology Market

Global Industrial Paper Shredder Machine Market

Global Land Mobile Radio Market

Global Low Voltage Motor Market

Global Medical Power Supply Market

Global Mobile Satellite Services Market

Global Online Testing Software Market

Global Paraformaldehyde Market

Global Patch Cable Market

Global Pouches Market

Global Predictive Genetic Counselling Market

Global Processed Fruit Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness