Philippines Private Health Insurance Market Market: Size, Share, Segments and Trend Outlook

"Latest Insights on Executive Summary Philippines Private Health Insurance Market Share and Size

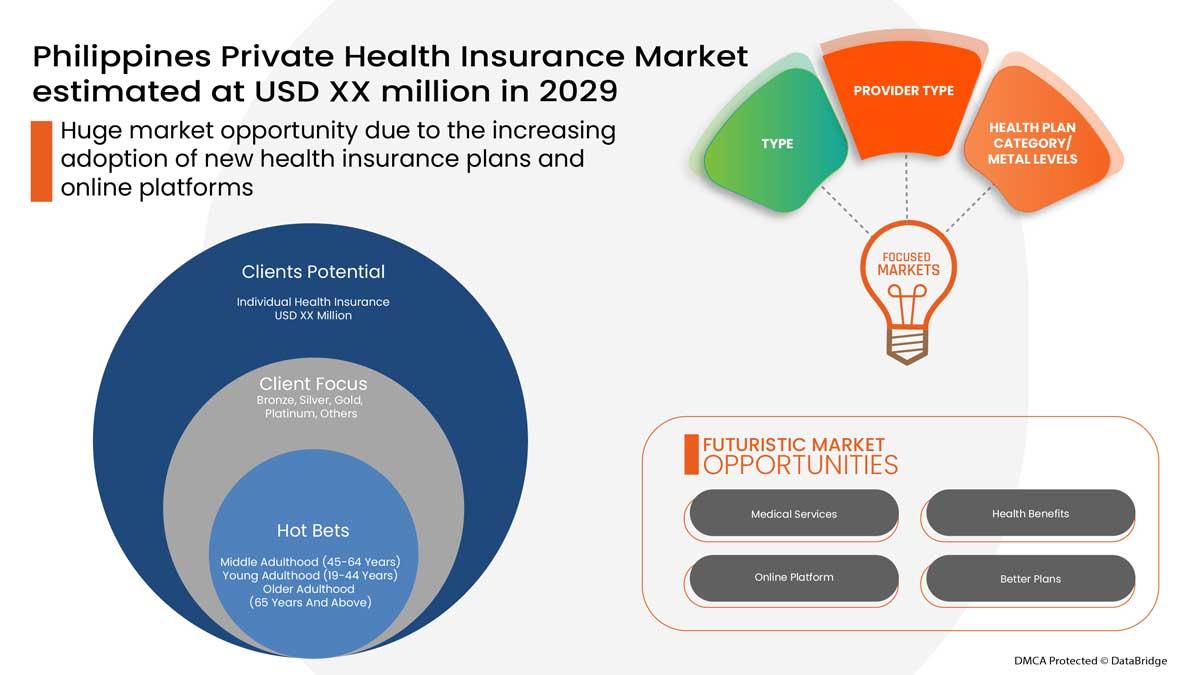

Data Bridge Market Research analyses that the Philippines private health insurance market is expected to reach the value of USD 1,273.12 million by the year 2029, at a CAGR of 1.2% during the forecast period.

Objectives of the Market research are kept in mind while preparing the reliable Philippines Private Health Insurance Market research report. Market analysis, market definition, currency and pricing, key developments and market categorization along with detailed research methodology are the key factors of this market report. Market segmentation study is carried out in terms of markets covered, geographic scope, years considered for the study, currency and pricing. For research methodology, primary interviews with key opinion leaders, DBMR market position grid, DBMR market challenge matrix, secondary sources, and assumptions are taken into account.

The finest Philippines Private Health Insurance Market report endows with current and upcoming technical and financial details of the industry to 2030 and hence proves to be a valuable source of information. The industry report can be accessible to the users in the form of PDF or spreadsheet. Moreover, PPT format can also be offered depending upon client’s requirement. Further, the statistical and numerical data including facts and figures are characterized very properly with the help of charts, tables or graphs. The data and information cited in the credible Philippines Private Health Insurance Market analysis report is very dependable as it is drawn only from the valuable and genuine resources.

Dive into the future of the Philippines Private Health Insurance Market with our comprehensive analysis. Download now:

https://www.databridgemarketresearch.com/reports/philippines-private-health-insurance-market

Philippines Private Health Insurance Business Outlook

Segments

- By Type: Under this segment, the private health insurance market in the Philippines can be classified into individual health insurance and group health insurance. Individual health insurance refers to policies purchased by individuals or families to cover their medical expenses. On the other hand, group health insurance is typically provided by employers to their employees as part of their benefits package.

- By Coverage: The market can also be segmented based on coverage into basic health insurance and comprehensive health insurance. Basic health insurance offers a limited amount of coverage for essential healthcare services, while comprehensive health insurance provides broader coverage, including more services and higher coverage limits.

- By Service Provider: Another way to segment the Philippines private health insurance market is based on service providers, such as insurance companies, health maintenance organizations (HMOs), and preferred provider organizations (PPOs). Each type of service provider offers different arrangements and networks for healthcare services.

Market Players

- Insular Life

- BPI-Philam Life Assurance Corporation

- Life & Health Insurance Foundation for Education

- Paramount Life & General Insurance Corporation

- Philam Life

- Maxicare Healthcare Corporation

- Pru Life Insurance Corporation of U.K.

- Asian Life and General Assurance Corporation

- Medilink Network, Inc.

- Intellicare

These market players play a significant role in shaping the landscape of the private health insurance market in the Philippines. They offer a range of insurance products and services catering to the diverse needs of individuals, families, and organizations seeking healthcare coverage.

The private health insurance market in the Philippines is witnessing significant growth driven by various factors such as increasing healthcare costs, rising awareness about the importance of health insurance, and the growing middle-class population with disposable income. With the shift towards preventive healthcare and the adoption of insurance products for financial security, market players are expanding their product portfolios and enhancing their distribution channels to reach a wider customer base. The market is becoming increasingly competitive, leading to innovations in insurance products, digitalization of services, and strategic partnerships to differentiate offerings and improve customer experience.

One of the key trends observed in the Philippines private health insurance market is the rising demand for customized insurance solutions. Consumers are looking for personalized insurance plans that cater to their specific healthcare needs, whether it be coverage for critical illnesses, maternity benefits, or access to a wide network of healthcare providers. This trend is driving insurers to develop tailored products that offer flexibility and value-added services to attract and retain customers in an increasingly crowded market.

Another important aspect shaping the market is the regulatory environment and government initiatives aimed at expanding healthcare coverage and promoting insurance uptake. With the implementation of universal healthcare programs and the push for mandatory health insurance coverage for certain sectors, insurers are adapting their strategies to comply with regulatory requirements while seizing opportunities for growth in mandated insurance segments.

Furthermore, the COVID-19 pandemic has underscored the importance of health insurance as a financial safety net during times of crisis. The outbreak has accelerated the digital transformation of the insurance industry, leading to the adoption of telemedicine services, online claims processing, and virtual customer interactions. Insurers that have embraced technology and agility in their operations have been able to better serve their policyholders and navigate the challenges posed by the pandemic.

Looking ahead, the Philippines private health insurance market is poised for continued growth, driven by factors such as increasing healthcare expenditure, changing consumer preferences, and the evolution of healthcare delivery models. Market players will need to stay attuned to market dynamics, regulatory developments, and emerging trends to stay competitive and meet the evolving needs of consumers in a rapidly changing healthcare landscape. Strategic partnerships, product innovation, and a customer-centric approach will be key differentiators for insurers looking to capture a larger share of the growing private health insurance market in the Philippines.The private health insurance market in the Philippines is highly dynamic and evolving, driven by various key factors and trends that are shaping the industry landscape. One significant aspect that is influencing the market is the increasing emphasis on personalized insurance solutions. Consumers are increasingly seeking tailored insurance plans that cater to their specific healthcare needs and preferences. This demand for customization is pushing insurers to develop innovative products that offer flexibility, value-added services, and unique benefits to attract and retain customers in a competitive market environment. As consumer expectations continue to evolve, insurers will need to focus on enhancing their product offerings and service capabilities to meet the growing demand for personalized health insurance solutions.

Another crucial factor impacting the private health insurance market in the Philippines is the regulatory environment and government initiatives aimed at expanding healthcare coverage and promoting insurance uptake. With the implementation of universal healthcare programs and mandatory health insurance coverage for certain sectors, insurers are required to adapt their strategies and product offerings to comply with regulatory requirements while seizing growth opportunities in mandated insurance segments. The regulatory landscape plays a significant role in shaping the market dynamics and influencing the competitive strategies of market players in the private health insurance sector.

Furthermore, the ongoing COVID-19 pandemic has brought to light the critical importance of health insurance as a financial safety net during times of crisis. The global health crisis has accelerated the digital transformation of the insurance industry, leading to the rapid adoption of technology-driven solutions such as telemedicine services, online claims processing, and virtual customer interactions. Insurers that have embraced digital innovation and agility in their operations have been able to enhance customer service, streamline processes, and respond effectively to the challenges posed by the pandemic. The pandemic has prompted insurers to reevaluate their business models, introduce new digital initiatives, and prioritize customer engagement to meet the evolving needs of policyholders in a rapidly changing healthcare landscape.

In conclusion, the private health insurance market in the Philippines is poised for continued growth and innovation, driven by changing consumer preferences, regulatory developments, and technological advancements. Insurers will need to focus on offering personalized insurance solutions, navigating regulatory changes, and leveraging digital technologies to stay competitive and meet the evolving needs of customers in a rapidly changing healthcare ecosystem. By staying abreast of market trends, adapting to regulatory requirements, and embracing innovation, insurers can position themselves for success and sustainable growth in the dynamic private health insurance market in the Philippines.

Analyze detailed figures on the company’s market share

https://www.databridgemarketresearch.com/reports/philippines-private-health-insurance-market/companies

Philippines Private Health Insurance Market – Analyst-Ready Question Batches

- What is the current valuation of the global Philippines Private Health Insurance Market industry?

- What annual growth rate is expected for the next 5 years?

- What are the major segment breakdowns provided in the Philippines Private Health Insurance Market report?

- Who are the key contributors to the Philippines Private Health Insurance Market ecosystem?

- What cutting-edge products have entered the Philippines Private Health Insurance Market recently?

- What is the scope of geographical coverage in the Philippines Private Health Insurance Market analysis?

- What region is emerging as the growth hotspot?

- Which country could see dominance in future Philippines Private Health Insurance Market shares?

- Which region has the most established Philippines Private Health Insurance Market presence?

- Which country is on track for the fastest annual growth for Philippines Private Health Insurance Market?

Browse More Reports:

U.S. Dental Insurance Market

Global Nylon 66 Market

Europe Orthopedic Implants Market

Global Shopping Cart Market

Global Cardiac Computed Tomography (CCT) Market

Global Cake Pops Market

Global Online Food Delivery Market

Global Semiconductor Wafer Cleaning Equipment Market

Global Smart Hospitality Market

Middle East and Africa Medical Aesthetic Market

Europe Construction Management Software Market

Global Roofing Market

Global Gym Management Software Market

Global Demand Response Market

Global Audio Streaming Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness