Mobile Money Market Trends to Watch: Growth, Share, Segments and Forecast Data

"Executive Summary Mobile Money Market Market Opportunities by Size and Share

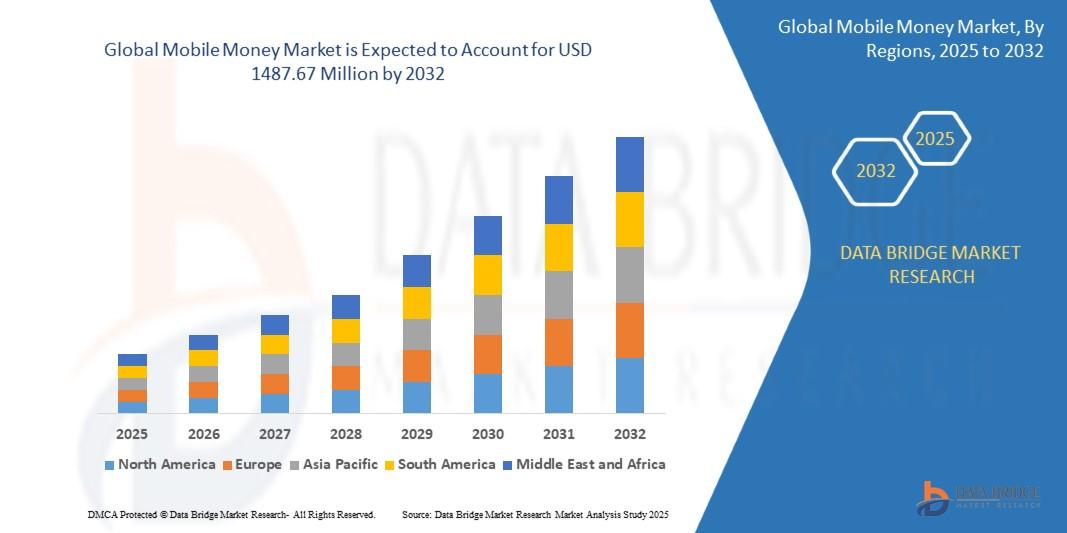

The global mobile money market was valued at USD 139.73 million in 2024 and is expected to reach USD 1487.67 million by 2032

Mobile Money Market Market research report is a verified and consistent source of information that puts forth a telescopic view of the existing market trends, emerging products, situations and opportunities. This information holds an immense significance to drive business towards the success. The industry report comprises of explicit and up to date information about the consumer’s demands, their likings, and their variable preferences about particular product. Mobile Money Market Market report all-inclusively guesstimates general market conditions, the growth scenario in the market, likely restrictions, major industry trends, market size, market share, sales volume and future trends.

Extremely talented minds have put in their lot of time for doing market research analysis and structure an all inclusive Mobile Money Market Market Furthermore, the report gives insights into revenue growth and sustainability initiative. This global market report includes all the company profiles of the major players and brands. This report endows clients with the information on their business scenario which aids to stay ahead of competition in today's swiftly revolutionizing business environment. The Mobile Money Market Market industry is anticipated to witness growth during the forecast period due to growing demand at the end user level.

Analyze top trends and market forces impacting the Mobile Money Market Market. Full report ready for download:

https://www.databridgemarketresearch.com/reports/global-mobile-money-market

Current Scenario of the Mobile Money Market Market

Segments

- By Transaction Mode: Peer to Peer, Peer to Business, Business to Peer, and Business to Business.

- By Nature of Payment: Person to Person, Person to Business, and Business to Person.

- By Application: Retail Payments, Ticketing, Airtime Top-Up, Money Transfers, Travel and Ticketing, and Others.

- By End-User: Personal and Business.

The global mobile money market is segmented on the basis of transaction mode, nature of payment, application, and end-user. In terms of transaction mode, the market is categorized into peer to peer, peer to business, business to peer, and business to business. Peer to peer transactions involve the transfer of funds from one individual to another, while peer to business transactions involve payments from individuals to businesses. Business to peer transactions are payments made by businesses to individuals, and business to business transactions involve transactions between different businesses. Based on the nature of payment, the market is divided into person to person, person to business, and business to person transactions. Person to person transactions involve payments between individuals, person to business transactions involve payments from individuals to businesses, and business to person transactions involve payments from businesses to individuals. In terms of application, the market is segmented into retail payments, ticketing, airtime top-up, money transfers, travel and ticketing, and other applications. Retail payments refer to transactions made at retail outlets using mobile money services, while ticketing involves the use of mobile money for purchasing tickets for various services. Airtime top-up refers to the practice of recharging mobile phone airtime using mobile money, while money transfers involve the transfer of funds from one account to another. Travel and ticketing involve using mobile money for purchasing travel tickets and other related services. Finally, the market is segmented based on end-users into personal and business users.

Market Players

- Vodafone Group Plc

- Gemalto

- Fidelity National Information Services, Inc.

- PayPal Holdings, Inc.

- Mastercard

- Bharti Airtel

- Orange S.A.

- MTN Group

- Safaricom

Key players operating in the global mobile money market include Vodafone Group Plc, Gemalto, Fidelity National Information Services, Inc., PayPal Holdings, Inc., Mastercard, Bharti Airtel, Orange S.A., MTN Group, and Safaricom. These companies are actively involved in the development and promotion of mobile money services, catering to a wide range of users across different geographies. Vodafone Group Plc, for example, offers M-Pesa mobile money services in several countries, allowing users to make payments and transfers easily through their mobile devices. Gemalto specializes in providing secure digital services, including mobile money solutions, to enhance user experience and security. Fidelity National Information Services, Inc. provides technology solutions for financial institutions and businesses to enable secure and convenient mobile money transactions. PayPal Holdings, Inc. is a leading online payment platform that offers mobile money services to users globally, facilitating seamless transactions across different platforms. Mastercard provides innovative payment solutions, including mobile money services, to enable users to make secure and convenient transactions. Bharti Airtel, Orange S.A., MTN Group, and Safaricom are also prominent market players offering mobile money services to their customers, enhancing financial inclusion and convenience.

The global mobile money market is witnessing significant growth due to the increasing adoption of digital payment methods, rising smartphone penetration, and the growing demand for convenient and secure financial transactions. One key trend shaping the market is the integration of mobile money services with advanced technologies such as artificial intelligence (AI), blockchain, and biometrics to enhance security and user experience. By leveraging AI algorithms, mobile money providers can streamline processes, detect fraudulent activities, and offer personalized services to users. The integration of blockchain technology ensures transparent and tamper-proof transactions, enhancing trust among users. Biometric authentication methods such as fingerprint scanning or facial recognition add an extra layer of security to mobile money transactions, reducing the risk of unauthorized access and fraud.

Another driving factor for the mobile money market is the increasing emphasis on financial inclusion efforts across emerging economies. Mobile money services enable unbanked individuals to access basic financial services such as payments, transfers, savings, and insurance through their mobile phones. This promotes financial empowerment, reduces cash dependency, and enhances economic opportunities for underserved populations. Governments and regulatory bodies are also supporting mobile money initiatives by implementing policies and regulations that promote a conducive environment for digital financial services. These initiatives are driving the adoption of mobile money among both individuals and businesses, fostering a cashless economy and driving overall market growth.

Moreover, the COVID-19 pandemic has accelerated the shift towards digital payment solutions, including mobile money, as consumers and businesses seek contactless and remote transaction options to mitigate the spread of the virus. The pandemic has highlighted the importance of cashless payments for ensuring business continuity and safe transactions. As a result, mobile money providers are witnessing an increase in demand for their services, leading to the introduction of innovative offerings such as QR code payments, NFC technology, and mobile wallets to meet evolving customer needs. The pandemic has acted as a catalyst for the digital transformation of the financial sector, driving the adoption of mobile money as a convenient and secure payment solution in the new normal.

In conclusion, the global mobile money market continues to evolve rapidly, driven by technological advancements, increasing financial inclusion efforts, and changing consumer preferences. Market players are focusing on innovation, strategic partnerships, and geographical expansion to capitalize on the growing demand for mobile money services worldwide. As the market landscape continues to evolve, mobile money is expected to play a pivotal role in shaping the future of digital payments, offering users seamless, secure, and convenient financial transactions on-the-go.The global mobile money market is a dynamic and rapidly growing industry that is witnessing significant evolution and expansion driven by technological innovation, changing consumer behaviors, and the increasing adoption of digital financial services. Market segmentation based on transaction mode, nature of payment, application, and end-user provides a comprehensive overview of the diverse landscape of mobile money services. With various transaction modes such as peer to peer, peer to business, business to peer, and business to business, the market caters to a wide range of payment needs and preferences. Similarly, the segmentation based on the nature of payment reflects the versatility of mobile money services, enabling individuals and businesses to make seamless transactions across different platforms.

Key market players such as Vodafone Group Plc, Gemalto, Fidelity National Information Services, Inc., PayPal Holdings, Inc., Mastercard, Bharti Airtel, Orange S.A., MTN Group, and Safaricom are at the forefront of driving innovation and expansion in the mobile money market. These companies offer a variety of services and solutions aimed at enhancing financial inclusion, convenience, and security for users globally. From e-commerce transactions to utility bill payments, these market players are instrumental in shaping the future of digital payments, transforming the way individuals and businesses manage their finances.

The integration of advanced technologies such as artificial intelligence, blockchain, and biometrics is a key trend influencing the mobile money market, enhancing security, efficiency, and user experience. By leveraging AI algorithms for fraud detection and personalized services, mobile money providers can offer seamless and secure transactions to their customers. The adoption of blockchain technology ensures transparency and trust in transactions, while biometric authentication methods add an extra layer of security to mobile money services.

Furthermore, the COVID-19 pandemic has accelerated the shift towards digital payment solutions, including mobile money, as consumers and businesses prioritize contactless and remote transaction options. This sudden shift has underscored the importance of mobile money services in ensuring business continuity and safe financial transactions in a rapidly changing environment. As a result, mobile money providers are adapting to meet the evolving needs of customers by introducing innovative payment solutions such as QR code payments and mobile wallets.

In conclusion, the global mobile money market is poised for continued growth and innovation as advancements in technology, changing consumer preferences, and the increasing emphasis on financial inclusion drive market dynamics. Market players will continue to focus on digital transformation, strategic partnerships, and geographical expansion to capitalize on the expanding opportunities in the mobile money ecosystem. As mobile money services become increasingly integrated into daily financial activities, they are expected to play a crucial role in shaping the future of digital payments and driving financial inclusion globally.

Access segment-wise market share of the company

https://www.databridgemarketresearch.com/reports/global-mobile-money-market/companies

Targeted Question Batches for Mobile Money Market Market Exploration

- What is the global financial outlook of the Mobile Money Market Market?

- What growth levels are predicted across Mobile Money Market Market segments?

- What segmentation structure does the Mobile Money Market Market report follow?

- Which companies are the largest by Mobile Money Market Market capitalization?

- What nations are identified as growth drivers for Mobile Money Market Market?

- Who are the fastest-growing competitors in the Mobile Money Market Market?

Browse More Reports:

Asia-Pacific Gummies and Jellies Market

Asia-Pacific Refrigerant Market

Australia Pro AV (Audio-Visual) Market

Global AI Video Analytics Market

Global Anti-Cancer Drug Market

Global Antithrombotic Drugs Market

Global Artificial Intelligence in Healthcare Market

Global Artificial Intelligence Market

Global Ashwagandha Market

Global Automotive Interior Materials Market

Global Biochar Market

Global Ceramics Market

Global Collagen Market

Global Compostable Packaging Market

Global Cosmetic Packaging Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness