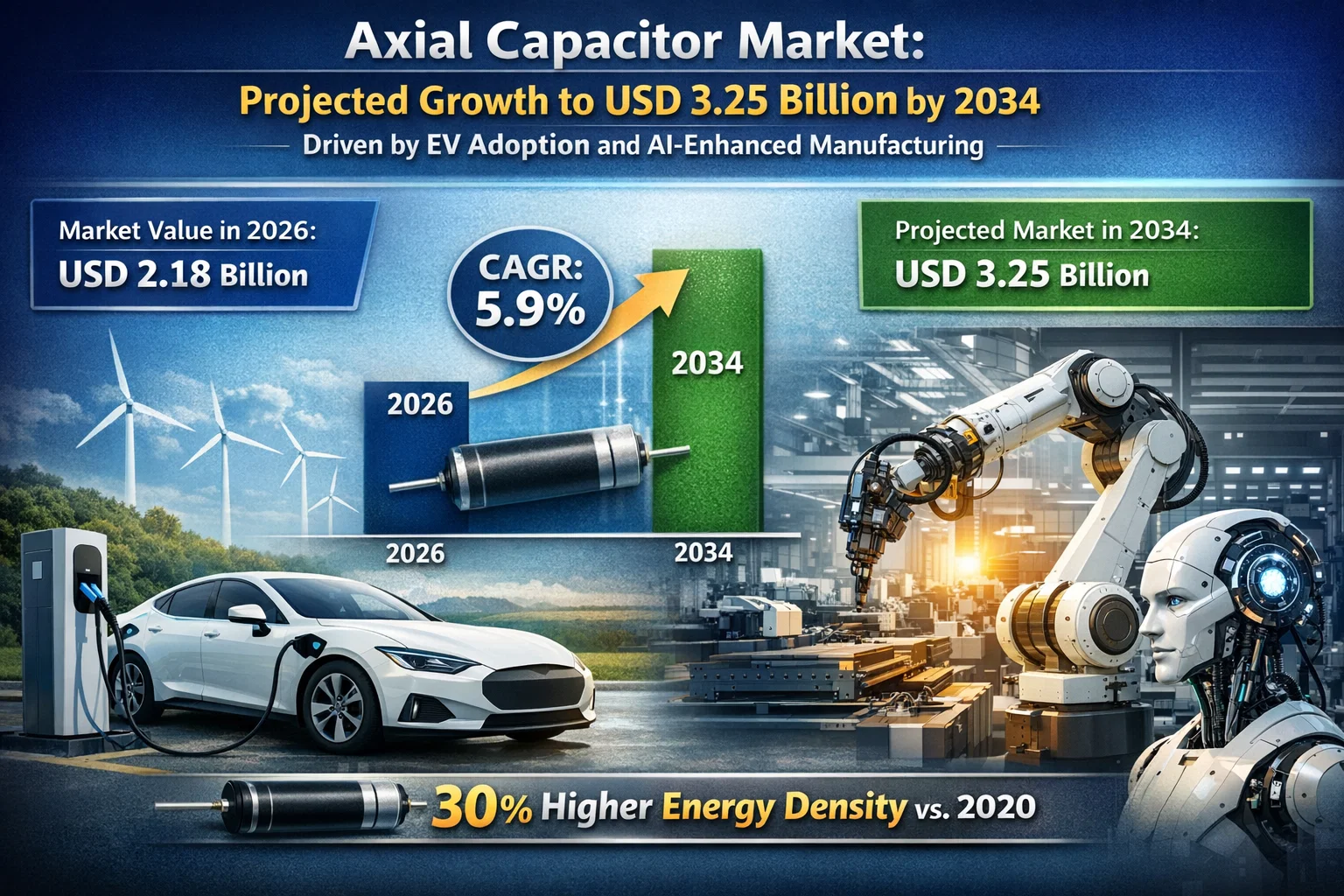

Axial Capacitor Market: Projected Growth to USD 3.25 Billion by 2034 Driven by EV Adoption

Global Axial Capacitor Market, valued at USD 2.18 billion in 2026, is on a steady trajectory to reach USD 3.25 billion by 2034, growing at a CAGR of 5.9%. As of early 2026, the market has transitioned from being viewed as a legacy technology to a critical "high-reliability" asset. While surface-mount technology (SMT) dominates the consumer volume, axial configurations are seeing a renaissance in high-vibration and high-voltage environments, particularly in the Electric Vehicle (EV) and Industrial 4.0 sectors.

The market in 2026 is defined by a strategic shift toward AI-driven quality control and material science breakthroughs that allow axial components to achieve 30% higher energy density than their 2020 predecessors.

Download Full Report: https://semiconductorinsight.com/report/axial-capacitor-market/

Key Market Dynamics in 2026

The industry is currently navigating a complex balance between physical size constraints and increasing power demands.

- The 800V EV Migration: A primary driver in 2026 is the automotive industry's shift from 400V to 800V architectures. Axial film and aluminum electrolytic capacitors are being redesigned with Low-ESR (Equivalent Series Resistance) and self-healing properties to manage the rapid switching of Silicon Carbide (SiC) semiconductors in traction inverters.

- AI-Optimized Production: Leading firms like TDK and KEMET have integrated machine learning into their winding and aging processes. This has reduced dielectric defects by an estimated 15%, significantly lowering the "Zero-Defect" costs required for aerospace and medical applications.

- Supply Chain Volatility: As of Q1 2026, the market remains sensitive to the pricing of high-purity aluminum foil and specialty polymers (PP/PET). Geopolitical shifts have led to lead times of 20+ weeks for specialized "mil-spec" axial variants, forcing a move toward regionalized manufacturing in North America and Europe.

Market Segmentation: Ceramic Stability and Automotive Surge

The market is diversifying into specialized material types to meet next-generation electrical stress requirements.

Segment Analysis:

- By Type

- Ceramic Capacitors (Market Leader): Valued at nearly USD 380 million, this segment is prized for high-frequency stability. The move toward X8R dielectric formulations allows these components to operate reliably up to 150°C.

- Aluminum Electrolytic: Remains the standard for bulk energy storage and power supply filtering due to its high volumetric efficiency.

- Film Capacitors: Showing the fastest growth in high-voltage DC-link applications for renewable energy inverters.

- By Application

- Consumer Electronics (Largest Share): Currently accounts for over 35% of demand. While SMT is preferred, axial types remain vital in home appliances and high-end audio equipment where through-hole durability is required.

- Automotive: Growing at a robust rate due to the electrification of powertrains. Axial designs are increasingly specified for their vibration resistance in engine compartments.

- Defense & Aerospace: A high-margin niche where axial capacitors are mandatory for mission-critical avionics that must withstand extreme G-forces.

Key Axial Capacitor Manufacturers

- Cornell Dubilier (CDE) (U.S.) - A leader in power electronics and military-grade capacitors.

- TDK Corporation (Japan) - Dominant in material innovation and low-ESR electrolytic solutions.

- KEMET (a Yageo Company) (U.S.) - Leading the shift toward high-reliability automotive ceramics.

- Kyocera AVX (U.S.) - Specializing in advanced tantalum and polymer axial designs.

- Vishay Intertechnology (U.S.) - Recently expanded capacity for high-voltage industrial film capacitors.

- Nichicon Corporation (Japan) - Strong focus on aluminum electrolytic for the EV market.

- United Chemi-Con (UCC) (Japan) - Major supplier for power supply and industrial automation.

Regional Outlook: China’s Speed vs. U.S. R&D

- Asia-Pacific: Currently holds over 60% of the market share. China is the fastest-growing sub-region (5.3% CAGR) due to its massive EV battery production base and state-backed "Smart Grid" initiatives.

- North America: The U.S. market (28% of global revenue in 2024) remains the center for R&D and Specialty Capacitors. Reshoring initiatives under the CHIPS Act are driving new domestic production lines for defense-certified components.

- Europe: Driven by German automotive OEMs and French aerospace leaders, with a growing focus on Eco-friendly/RoHS-compliant bio-based electrolytes.

Report Scope and Availability

This comprehensive research report covers the global and regional Axial Capacitor markets for the forecast period 2025–2032. It provides detailed data on unit shipments, pricing trends, and the impact of 48V Mild Hybrid systems on component demand.

Download Full Report: https://semiconductorinsight.com/report/axial-capacitor-market/

Download Sample Report: https://semiconductorinsight.com/download-sample-report/?product_id=108032

About Semiconductor Insight

Semiconductor Insight is a premier global intelligence firm specializing in passive components, power electronics, and semiconductor materials. Our 2026 forecasts help global OEMs navigate the increasingly complex intersection of material science and electronic miniaturization.

Website: https://semiconductorinsight.com/

LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

International Support: +91 8087 99 2013

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness