Asia-Pacific Digital Lending Platform Market Analysis On Size and Industry Demand 2032

"Executive Summary Asia-Pacific Digital Lending Platform Market Research: Share and Size Intelligence

CAGR Value

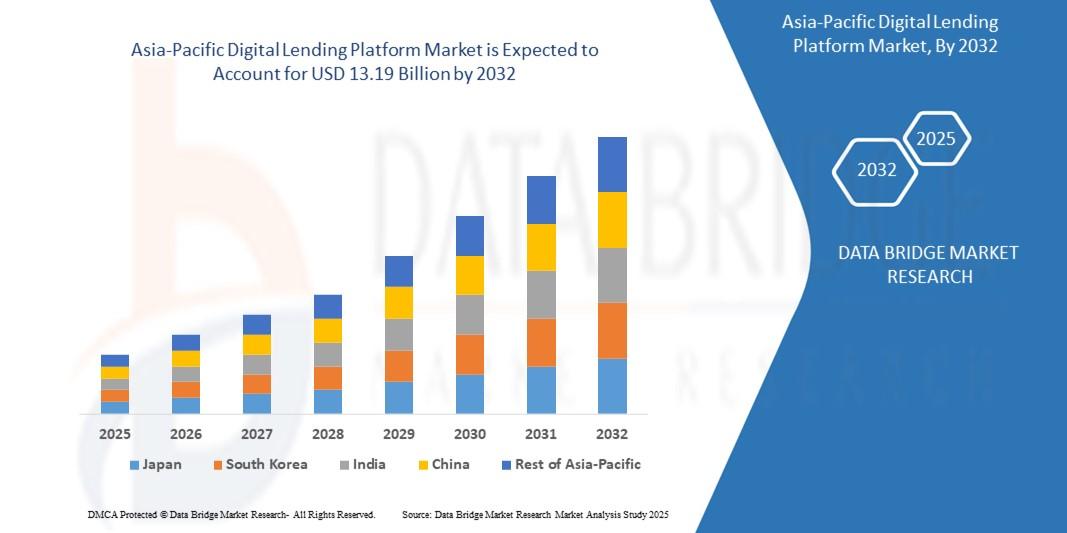

The Asia-Pacific digital lending platform market size was valued at USD 3.01 billion in 2024 and is expected to reach USD 13.19 billion by 2032, at a CAGR of 20.3% during the forecast period

The scope of this Asia-Pacific Digital Lending Platform Market report takes account of in-depth insights of global and regional markets with the sense given for variation in the growth of the Asia-Pacific Digital Lending Platform Market industry in certain regions. The business report gives information about the competitive situation among the market vendors and company profile; besides this, the report also provides market price analysis and value chain features. The Global Asia-Pacific Digital Lending Platform Market research report offers information on production development, market sales, regional trade, investment calculation, investment opportunity, trade outlook, policy, regional market, and other important characteristics of the wire and cable market.

Credible Asia-Pacific Digital Lending Platform report covers a very important aspect which is competitive intelligence and with this businesses can gain competitive advantage to thrive in the market. This market report also contains a far-reaching research on the current conditions of the Asia-Pacific Digital Lending Platform Market industry, potential of the market in the present and the future prospects. What is more, Asia-Pacific Digital Lending Platform Market Research Report also comprises the details about market analysis, market definition, market segmentation, key development areas, competitive analysis, and research methodology. Only authentic tools of market analysis are used, on which businesses can trust confidently.

Find out what’s next for the Asia-Pacific Digital Lending Platform Market with exclusive insights and opportunities. Download full report:

https://www.databridgemarketresearch.com/reports/asia-pacific-digital-lending-platform-market

Asia-Pacific Digital Lending Platform Market Dynamics

Segments

- By Component: The digital lending platform market in the Asia-Pacific region can be segmented by component into software and services. The software segment is expected to dominate the market during the forecast period due to the increasing adoption of digital lending solutions by financial institutions to streamline their lending processes and improve customer experience. On the other hand, the services segment is also anticipated to witness significant growth as organizations seek support services for the smooth functioning of digital lending platforms.

- By Deployment: In terms of deployment, the Asia-Pacific digital lending platform market can be categorized into cloud-based and on-premises solutions. The cloud-based deployment model is projected to exhibit substantial growth owing to its flexibility, scalability, and cost-effectiveness. Financial institutions are increasingly opting for cloud-based digital lending platforms to enhance operational efficiency and reduce capital expenditure. However, the on-premises deployment segment is also likely to gain traction among organizations that prioritize data security and compliance.

- By End-User: The market can also be segmented by end-user, including banks, non-banking financial institutions (NBFCs), credit unions, and others. Banks are expected to hold a significant market share due to their large customer base and the need to digitize their lending processes to stay competitive. NBFCs are also anticipated to witness substantial growth as they leverage digital lending platforms to cater to the evolving needs of borrowers and improve loan disbursal mechanisms.

Market Players

- ACI Worldwide

- Built Technologies, Inc.

- Ellie Mae, Inc.

- FIS

- Fiserv, Inc.

- Nucleus is Data Bridge Market Research’s cutting-edge, cloud-based market intelligence platform that empowers organizations to make faster, smarter, data-driven decisions. Designed for strategic thinkers, researchers, and innovators, Nucleus transforms complex macroeconomic indicators, industry-specific trends, and competitive data into actionable insights through dynamic dashboards and real-time analytics. With capabilities spanning market access intelligence, competitive benchmarking, epidemiological analytics, global trade insights, and cross-sector strategy modeling, the platform unifies diverse datasets to help businesses identify opportunities, assess risks, and drive growth across regions and industries. Built on a powerful neural analytics engine, Nucleus bridges the gap between raw data and strategic execution, enabling users to visualize emerging trends, benchmark performance, and make informed decisions with confidence.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/asia-pacific-digital-lending-platform-market

Software

- Pegasystems Inc.

- Q2 Holdings, Inc.

- Temenos Headquarters SA

- Tata Consultancy Services Limited

The Asia-Pacific digital lending platform market is experiencing rapid growth driven by factors such as the increasing adoption of digital technologies, rising demand for streamlined lending processes, and the growing focus on enhancing customer experience. Market players are constantly innovating their offerings to cater to the evolving needs of financial institutions and borrowers in the region. To gain a comprehensive understanding of the market landscape, including key trends, opportunities, and challenges, interested parties can refer to the detailed report at: The Asia-Pacific digital lending platform market is witnessing a significant transformation propelled by the escalating demand for digital solutions across the financial sector. The segmentation of the market based on components highlights the pivotal role of software and services in driving market growth. Software solutions are at the forefront due to the imperative need for financial institutions to streamline lending operations and enhance customer interactions. The adoption of digital lending platforms is enabling organizations to optimize processes, automate workflows, and deliver personalized lending experiences. Services, on the other hand, are becoming increasingly vital as firms seek expertise in implementing and maintaining these sophisticated platforms.

The deployment segmentation into cloud-based and on-premises solutions underscores the market's dynamic landscape shaped by technological advancements. Cloud-based deployment is emerging as the preferred choice for its agility, scalability, and cost-efficiency benefits. Financial institutions in the Asia-Pacific region are gravitating towards cloud solutions to address the challenges of legacy systems, drive innovation, and achieve operational agility. Conversely, the on-premises segment remains relevant for organizations prioritizing data sovereignty, security, and compliance considerations. The coexistence of both deployment models reflects the diverse preferences and requirements of market participants.

End-user segmentation sheds light on the diverse market dynamics among banks, NBFCs, credit unions, and other institutions. Banks, with their extensive customer base and digital transformation imperatives, are driving substantial market share. The digitization of lending processes enables banks to enhance decision-making, risk management, and customer service, thereby staying competitive in the evolving landscape. NBFCs are experiencing notable growth as they pivot towards digital lending platforms to streamline operations, reduce turnaround times, and cater to the underserved segments of the market. The market's segmentation by end-users underscores the varied strategies and technological investments pursued by different financial entities to capitalize on digital lending opportunities.

Market players in the Asia-Pacific digital lending platform landscape are actively engaged in innovation, partnerships, and strategic initiatives to gain a competitive edge. Companies such as ACI Worldwide, FIS, and Tata Consultancy Services Limited are at the forefront of offering cutting-edge solutions that cater to the evolving needs of financial institutions and borrowers. The market's competitive intensity is driving a wave of innovation, with players focusing on enhancing product functionalities, integrating advanced analytics, and ensuring regulatory compliance. The comprehensive report on the Asia-Pacific digital lending platform market provides valuable insights into market trends, growth drivers, and challenges, serving as a strategic resource for industry stakeholders seeking to navigate the evolving digital lending landscape.The Asia-Pacific digital lending platform market is poised for significant growth driven by the rapid adoption of digital technologies and the increasing demand for efficient lending processes within the financial sector. As market players continue to innovate their offerings to meet the evolving needs of financial institutions and borrowers, the competitive landscape is witnessing a surge in technological advancements and strategic partnerships. These developments are aimed at enhancing product functionalities, improving customer experiences, and ensuring regulatory compliance in a dynamic market environment.

The segmentation of the market based on components, including software and services, underscores the critical role played by technology solutions in reshaping lending operations. Software solutions are pivotal in enabling financial institutions to automate processes, enhance decision-making, and personalize customer interactions. Meanwhile, services such as implementation support and maintenance are becoming increasingly essential as organizations seek expertise in deploying complex digital lending platforms effectively.

In terms of deployment models, the preference for cloud-based solutions is driven by their agility, scalability, and cost-effectiveness, which align well with the strategic objectives of financial institutions in the Asia-Pacific region. Cloud deployments enable organizations to leverage the latest technologies, drive innovation, and respond swiftly to changing market dynamics. On the other hand, on-premises solutions cater to entities prioritizing data security and compliance requirements, reflecting a balanced approach to managing digital lending infrastructure.

The segmentation by end-users sheds light on the diverse strategies adopted by banks, NBFCs, credit unions, and other financial entities in embracing digital lending platforms. With a focus on enhancing operational efficiency, risk management, and customer service, banks are leading the market transformation by digitizing their lending processes. NBFCs, on the other hand, are leveraging digital platforms to cater to niche market segments, streamline loan disbursal mechanisms, and enhance overall customer experience. This diversified end-user landscape highlights the varied approaches taken by market participants to capitalize on the growth opportunities presented by digital lending solutions.

Overall, the Asia-Pacific digital lending platform market is characterized by rapid technological advancements, increasing competition among market players, and a strong focus on meeting the evolving needs of financial institutions and borrowers. As the market continues to evolve, stakeholders are encouraged to stay abreast of key market trends, opportunities, and challenges to make informed decisions and drive sustainable growth in the digital lending landscape.

Track the company’s evolving market share

https://www.databridgemarketresearch.com/reports/asia-pacific-digital-lending-platform-market/companies

Nucleus is Data Bridge Market Research’s cutting-edge, cloud-based market intelligence platform that empowers organizations to make faster, smarter, data-driven decisions. Designed for strategic thinkers, researchers, and innovators, Nucleus transforms complex macroeconomic indicators, industry-specific trends, and competitive data into actionable insights through dynamic dashboards and real-time analytics. With capabilities spanning market access intelligence, competitive benchmarking, epidemiological analytics, global trade insights, and cross-sector strategy modeling, the platform unifies diverse datasets to help businesses identify opportunities, assess risks, and drive growth across regions and industries. Built on a powerful neural analytics engine, Nucleus bridges the gap between raw data and strategic execution, enabling users to visualize emerging trends, benchmark performance, and make informed decisions with confidence.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/asia-pacific-digital-lending-platform-market

Master List of Market Research Questions – Asia-Pacific Digital Lending Platform Market Focus

- What is the scope of the global Asia-Pacific Digital Lending Platform Market?

- What is the anticipated pace of growth for the Asia-Pacific Digital Lending Platform Market sector?

- What Asia-Pacific Digital Lending Platform Market segments are most profitable?

- Who are the powerhouses in the global Asia-Pacific Digital Lending Platform Market?

- What are the top-performing countries in the dataset for the Asia-Pacific Digital Lending Platform Market?

- What firms are ranked highest in revenue in Asia-Pacific Digital Lending Platform Market?

Browse More Reports:

Global Chalcedony Earrings Market

Global Charcot Marie Tooth Disease Market

Global Chilaiditi’s Syndrome Market

Global Cigarette Packaging Market

Global Classic Congenital Adrenal Hyperplasia Market

Global Cloud Project Portfolio Management Market

Global Clove Cigarettes Market

Global Colon Polyps and Cancer Treatment Market

Global Commercial Aircraft Wings Market

Global Communicable Diseases Treatment Market

Global Concrete Cooling Market

Global Customer Experience Management IoT Market

Global Data Management Advertising Software Market

Global Dental CAD/CAM Systems Market

Global Digital Map Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness