Modernizing Corporate Finance and Competitive Landscape Outlook to 2032 Middle East and Africa Treasury Software Market

"Market Trends Shaping Executive Summary Middle East and Africa Treasury Software Market Size and Share

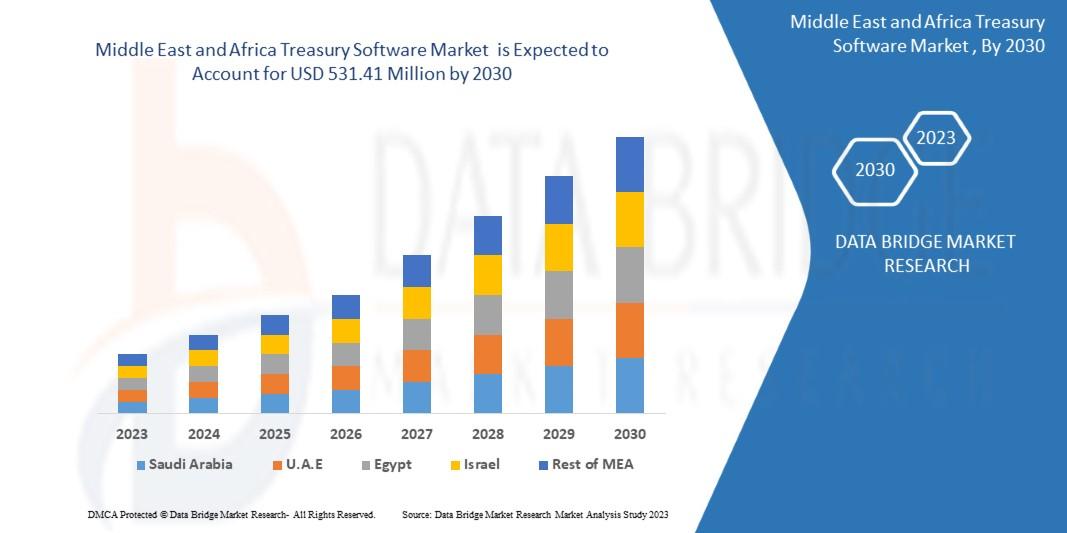

Data Bridge Market Research analyses that the market is growing with the CAGR of 2.5% in the forecast period of 2023 to 2030 and expected to reach USD 531.41 million by 2030. Increase in the requirement of quick-decision making process in biotechnology is e expected to drive the growth of the market significantly.

Middle East and Africa Treasury Software Market report performs geographical analysis for the major areas such as North America, China, Europe, Southeast Asia, Japan, and India, with respect to the production, price, revenue, and market share for top manufacturers. This market study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, distributors, and Porter's Five Forces Analysis. This Middle East and Africa Treasury Software Market research report delivers a comprehensive analysis of the market structure along with the estimations of the various segments and sub-segments of the market.

An absolute insight and know-how of the greatest market opportunities in the relevant markets or Middle East and Africa Treasury Software Market industry required for successful business growth can be accomplished only with the best market research report. The Middle East and Africa Treasury Software report provides market potential for each geographical region based on the growth rate, macroeconomic parameters, consumer buying patterns, their preferences for particular products, and market demand and supply scenarios. All the studies performed to generate this Middle East and Africa Treasury Software report are based on large group sizes and also at a global level. This Middle East and Africa Treasury Software Market Research report provides clients with the supreme level of market data and information that is specific to their niche and their business requirements.

Unlock detailed insights into the growth path of the Middle East and Africa Treasury Software Market. Download full report here:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-treasury-software-market

Middle East and Africa Treasury Software Industry Performance Overview

Segments

- By Component

- Software

- Services

- By Deployment Type

- Cloud-based

- On-premises

- By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Government

- Others

Market Players

- Oracle

- GTreasury

- Financial Sciences Corporation

- TreasuryXpress

- Calypso Technology Inc.

- Kyriba

- Gust.

The Middle East and Africa Treasury Software Market is witnessing significant growth driven by several key factors. The market is segmented based on components, deployment type, organization size, and end-user industries. The software segment dominates the market due to the increasing demand for advanced treasury management solutions. The services segment is also gaining traction as organizations seek professional assistance in implementing and managing treasury software.

In terms of deployment type, cloud-based solutions are experiencing higher adoption rates due to their flexibility, scalability, and cost-effectiveness. On-premises deployment is still prevalent among large enterprises that prioritize data security and control. Small and Medium-sized Enterprises (SMEs) are increasingly investing in treasury software to streamline their financial operations and enhance overall efficiency. Large enterprises continue to be major stakeholders in the market, driving the need for more advanced treasury solutions.

The end-user industries driving the demand for treasury software in the Middle East and Africa region include Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Retail, Healthcare, Government, and others. BFSI remains a prominent sector for treasury software adoption as financial institutions prioritize risk management and compliance. The retail sector is also witnessing significant growth in the adoption of treasury solutions to manage cash flows and optimize working capital.

Key market players in the Middle East and Africa Treasury Software Market include Oracle, GTreasury, Financial Sciences Corporation, TreasuryXpress, Calypso Technology Inc., Kyriba, and Gust. These companies offer a wide range of treasury management solutions catering to the diverse needs of organizations across different industries. With the increasing focus on digital transformation and automation in financial processes, these market players are continuously innovating their offerings to stay competitive in the market.

The Middle East and Africa Treasury Software Market is poised for further growth and evolution in the coming years. One emerging trend in the market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities into treasury software solutions. These technologies are being leveraged to enhance decision-making processes, automate routine tasks, and improve forecasting accuracy within treasury operations. As organizations in the region strive for greater efficiency and transparency in financial management, the adoption of AI and ML-powered treasury software is expected to rise.

Another significant development in the market is the increasing focus on cybersecurity within treasury software solutions. With the rising instances of cyber threats and data breaches, organizations are prioritizing the security of their financial data and transactions. Treasury software providers are responding to this demand by enhancing their solutions with robust encryption protocols, multi-factor authentication, and real-time monitoring capabilities to safeguard sensitive information. As cybersecurity remains a top concern for businesses across industries, the integration of advanced security features in treasury software is likely to become a key differentiator for market players.

Moreover, the evolving regulatory landscape in the Middle East and Africa region is influencing the development of treasury software solutions. As regulatory requirements become more stringent and complex, organizations are turning to treasury software to ensure compliance with laws and regulations governing financial transactions. Market players are enhancing their software offerings with built-in compliance functionalities, audit trails, and reporting tools to help businesses adhere to regulatory standards effectively. The ability of treasury software to adapt to changing regulatory environments and automate compliance processes is expected to drive its adoption among businesses in the region.

Furthermore, the shift towards mobile-based treasury solutions is gaining traction in the Middle East and Africa market. With the increasing prevalence of remote work and the need for real-time access to financial data, organizations are seeking mobile-friendly treasury software that enables secure access to treasury functions from anywhere, at any time. Market players are investing in developing mobile applications with intuitive interfaces, dashboard views, and reporting capabilities to empower treasury professionals with on-the-go visibility and control over financial operations. The convenience and agility offered by mobile treasury solutions are resonating with organizations looking to enhance their cash management processes and decision-making efficiency.

In conclusion, the Middle East and Africa Treasury Software Market are characterised by ongoing technological advancements, a growing emphasis on cybersecurity, regulatory compliance requirements, and the proliferation of mobile-based solutions. As businesses in the region continue to digitalize their financial operations and optimize treasury functions, market players will need to innovate and adapt their offerings to meet the evolving needs of customers across industries. By leveraging emerging technologies, enhancing security measures, addressing regulatory complexities, and delivering mobile-friendly solutions, treasury software providers can capitalize on the expanding market opportunities in the Middle East and Africa region.The Middle East and Africa Treasury Software Market is a dynamic landscape with multiple factors driving its growth and evolution. One of the key trends shaping the market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities into treasury software solutions. By incorporating AI and ML technologies, organizations can enhance their decision-making processes, automate routine tasks, and improve forecasting accuracy, leading to increased efficiency and performance within treasury operations. This trend aligns with the broader industry shift towards digital transformation and automation, highlighting the importance of advanced technologies in optimizing financial processes.

Cybersecurity is another critical aspect influencing the development of treasury software solutions in the Middle East and Africa region. With the growing prevalence of cyber threats and data breaches, organizations are increasingly prioritizing the security of their financial data and transactions. Treasury software providers are responding to this need by incorporating robust encryption protocols, multi-factor authentication, and real-time monitoring capabilities to ensure the protection of sensitive information. As cybersecurity concerns continue to rise across industries, the focus on enhancing security features within treasury software is becoming a competitive differentiator for market players, as businesses seek trusted and secure solutions to manage their financial operations.

The evolving regulatory landscape in the Middle East and Africa is also playing a significant role in shaping the treasury software market. As regulatory requirements become more stringent and complex, organizations are turning to treasury software to manage compliance with financial laws and regulations effectively. Market players are enhancing their software offerings with built-in compliance functionalities, audit trails, and reporting tools to assist businesses in meeting regulatory standards. The ability of treasury software to adapt to changing regulatory environments and streamline compliance processes is expected to drive its adoption among businesses seeking to navigate the regulatory complexities of the region.

Additionally, the trend towards mobile-based treasury solutions is gaining momentum in the Middle East and Africa market. With the increasing need for real-time access to financial data and the rise of remote work environments, organizations are demanding mobile-friendly treasury software that offers secure access to treasury functions on-the-go. Market players are investing in developing mobile applications with user-friendly interfaces, dashboard views, and reporting capabilities to empower treasury professionals with anytime, anywhere access to critical financial information. This shift towards mobile treasury solutions underscores the importance of agility and convenience in modern financial management practices, enabling organizations to enhance cash management processes and decision-making efficiency.

In conclusion, the Middle East and Africa Treasury Software Market present a landscape characterized by technological innovation, cybersecurity focus, regulatory compliance requirements, and the adoption of mobile-based solutions. As businesses in the region continue to digitize their financial operations and optimize treasury functions, market players must remain agile and responsive to these changing dynamics. By leveraging emerging technologies, prioritizing security measures, addressing regulatory challenges, and delivering mobile-friendly solutions, treasury software providers can position themselves effectively in the market and cater to the evolving needs of organizations across industries.

Check out detailed stats on company market coverage

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-treasury-software-market/companies

Nucleus is Data Bridge Market Research’s cutting-edge, cloud-based market intelligence platform that empowers organizations to make faster, smarter, data-driven decisions. Designed for strategic thinkers, researchers, and innovators, Nucleus transforms complex macroeconomic indicators, industry-specific trends, and competitive data into actionable insights through dynamic dashboards and real-time analytics. With capabilities spanning market access intelligence, competitive benchmarking, epidemiological analytics, global trade insights, and cross-sector strategy modeling, the platform unifies diverse datasets to help businesses identify opportunities, assess risks, and drive growth across regions and industries. Built on a powerful neural analytics engine, Nucleus bridges the gap between raw data and strategic execution, enabling users to visualize emerging trends, benchmark performance, and make informed decisions with confidence.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/middle-east-and-africa-treasury-software-market

In-Depth Market Research Questions for Middle East and Africa Treasury Software Market Studies

- What revenue figures define the current Middle East and Africa Treasury Software Market?

- What are the near-term and long-term growth rates expected in Middle East and Africa Treasury Software Market?

- What are the dominant segments in the Middle East and Africa Treasury Software Market overview?

- Which companies are covered in the competitor analysis for Middle East and Africa Treasury Software Market?

- What countries are considered major contributors for Middle East and Africa Treasury Software Market?

- Who are the high-growth players in the Middle East and Africa Treasury Software Market?

Browse More Reports:

Middle East and Africa Polyvinyl Chloride (PVC) Compound Market

Middle East and Africa Personal Watercraft Market

Europe Personal Watercraft Market

Europe Passenger Information System Market

U.S. Palmoplantar Pustulosis (PPP) Market

Asia-Pacific Identity Verification Market

Europe Horticulture Lighting Market

Europe Golf Apparel, Footwear, and Accessories Market

North America Golf Apparel, Footwear, and Accessories Market

Europe Fuse Market

Middle East and Africa Foot and Ankle Allografts Market

India Electric Vehicle Market

Europe Digital Health Monitoring Devices Market

Middle East and Africa Diabetic Assays Market

Asia-Pacific Dental Infection Control Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness