Treasury Software Market Asia-Pacific Insights 2032 : Digital Transformation, FinTech Growth, and Strategic Regional

"Market Trends Shaping Executive Summary Asia-Pacific Treasury Software Market Size and Share

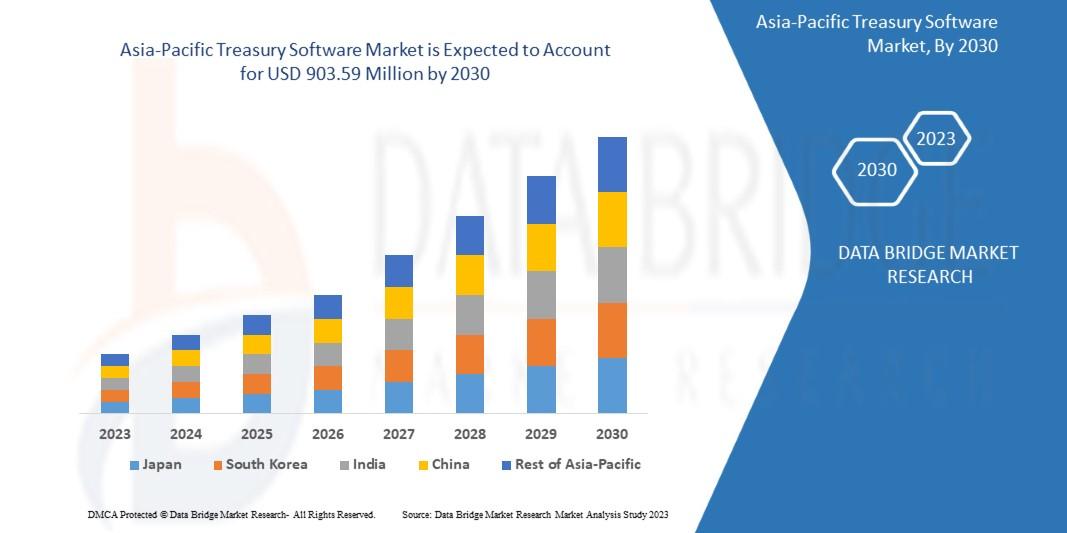

Data Bridge Market Research analyses that the market is growing with the CAGR of 3.6% in the forecast period of 2023 to 2030 and expected to reach USD 903.59 million by 2030. Increase in the requirement of quick-decision making process in biotechnology is e expected to drive the growth of the market significantly.

This Asia-Pacific Treasury Software Market report covers a myriad of aspects of the market analysis that many businesses call for. This market report comprises of a chapter on the global market and all of its associated companies with their profiles, which gives important information and data pertaining to their outlook in terms of finances, product portfolios, investment plans, and marketing and business strategies. The Asia-Pacific Treasury Software report also presents a profound overview of product specification, technology, applications, product type and production analysis, considering major factors such as Revenue, Cost, Gross and Gross Margin about Asia-Pacific Treasury Software Market

Ever-increasing competition has kept many challenges in front of the businesses. To beat these challenges and ride fast in the industry, Asia-Pacific Treasury Software Market Research Report is the key. The company profiles of all the top market players and brands with moves like product launches, joint ventures, mergers, and acquisitions, which in turn are affecting the sales, import, export, revenue, and CAGR values, are revealed in this Asia-Pacific Treasury Software Market report. Businesses can acquire knowledge about a complete background analysis of the industry, which includes an assessment of the parental market. Key market dynamics of the Asia-Pacific Treasury Software Market industry are the best part about this Asia-Pacific Treasury Software Market research report.

Unlock detailed insights into the growth path of the Asia-Pacific Treasury Software Market. Download full report here:

https://www.databridgemarketresearch.com/reports/asia-pacific-treasury-software-market

Asia-Pacific Treasury Software Industry Performance Overview

Segments

- By Deployment

- Cloud-Based

- On-Premises

- By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

- By Component

- Software

- Services

- By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Healthcare

- IT and Telecom

- Others

The Asia-Pacific Treasury Software market is segmented on the basis of deployment, organization size, component, and vertical. In terms of deployment, the market is divided into cloud-based and on-premises solutions. Cloud-based solutions offer flexibility, scalability, and cost-effectiveness, which are driving their adoption among businesses of all sizes. On the other hand, on-premises solutions offer better customization and security features for organizations with specific compliance requirements. When it comes to organization size, the market caters to both small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly investing in treasury software to streamline their financial operations and improve decision-making processes. Large enterprises are adopting treasury software to manage complex financial processes across multiple business units and geographies. The market is also segmented by component, with offerings including both software and services. Software solutions form the core of treasury management systems, providing functionalities such as cash management, risk management, and compliance. Services such as implementation, training, and support are essential for ensuring the successful deployment and optimization of treasury software. Lastly, the market is segmented by vertical, with key sectors including banking, financial services, and insurance (BFSI), retail, healthcare, IT and telecom, and others. Each vertical has unique treasury requirements, driving the demand for specialized software solutions tailored to their specific needs.

Market Players

- Fusang Corp.

- Kyriba Corp.

- CAPIX

- SimCorp

- Broadridge Financial Solutions, Inc.

- WISER

- FIS

- Intimus

- Bellin

- SAP SE

The Asia-Pacific Treasury Software market is highly competitive, with a range of established players and emerging vendors offering innovative solutions to meet the evolving needs of organizations in the region. Fusang Corp., Kyriba Corp., CAPIX, SimCorp, and Broadridge Financial Solutions, Inc. are among the key players in the market, known for their comprehensive treasury management offerings and strong customer base. WISER, FIS, Intimus, Bellin, and SAP SE are also prominent players, driving innovation and market growth through continuous product development and strategic partnerships. These market players are focusing on expanding their presence in the Asia-Pacific region by offering localized solutions, enhancing customer support services, and leveraging advanced technologies such as artificial intelligence and blockchain to deliver next-generation treasury software solutions.

The Asia-Pacific Treasury Software market is witnessing significant growth driven by various factors such as the increasing adoption of cloud-based solutions, the rising demand for efficient financial operations across organizations of all sizes, and the need for specialized software solutions tailored to specific industry requirements. One key trend shaping the market is the integration of advanced technologies like artificial intelligence and blockchain into treasury software solutions, enabling enhanced automation, real-time analytics, and improved risk management capabilities. Market players are focusing on developing more sophisticated features and functionalities to address the evolving challenges faced by treasury management professionals, including managing cash flow, mitigating financial risks, and ensuring regulatory compliance. Additionally, the market is experiencing a shift towards more user-friendly interfaces and intuitive design to improve user experience and increase adoption rates among organizations.

Furthermore, the Asia-Pacific Treasury Software market is witnessing increased consolidation and partnerships among key players to expand their market reach, enhance product portfolios, and strengthen their competitive positions. These strategic collaborations are enabling market players to offer comprehensive end-to-end treasury management solutions that cater to a wide range of industry verticals, including BFSI, retail, healthcare, IT, and telecom. The growing emphasis on data security and compliance is also driving investments in robust encryption technologies and regulatory tools to ensure the protection of sensitive financial information and adherence to global standards.

Moreover, the market is experiencing a surge in demand for customizable and scalable treasury software solutions that can adapt to the diverse needs of organizations operating in the Asia-Pacific region. Vendors are focusing on providing flexible deployment options, seamless integration with existing systems, and advanced reporting capabilities to enable organizations to make informed financial decisions and optimize their cash management processes. As digital transformation continues to reshape the financial landscape, treasury software solutions are expected to play a crucial role in enhancing operational efficiency, reducing overhead costs, and enabling better strategic planning for businesses across the Asia-Pacific region.

In conclusion, the Asia-Pacific Treasury Software market is poised for substantial growth in the coming years, driven by the increasing digitization of financial processes, the adoption of advanced technologies, and the evolving regulatory landscape. Market players will need to continue innovating and differentiating their offerings to stay competitive in this dynamic and rapidly evolving market. By addressing the unique needs of various industry verticals, improving user experience, and staying ahead of emerging trends, vendors can position themselves for long-term success and capitalize on the lucrative opportunities presented by the growing demand for treasury software solutions in the Asia-Pacific region.The Asia-Pacific Treasury Software market is currently witnessing robust growth propelled by several key factors driving market demand and innovation. One such factor is the increasing adoption of cloud-based solutions, which offer businesses flexibility, scalability, and cost-effectiveness. The migration to cloud-based treasury software solutions allows organizations to access their financial data from anywhere at any time, facilitating seamless collaboration and decision-making processes. Additionally, the rising demand for efficient financial operations across organizations of all sizes is fueling the market growth. Small and medium-sized enterprises (SMEs) are increasingly investing in treasury software to streamline their financial processes and gain a competitive edge, while large enterprises are adopting treasury solutions to manage complex financial operations across multiple business units and geographies.

Furthermore, the need for specialized software solutions tailored to specific industry requirements is driving market players to innovate and develop advanced features. Integration of technologies such as artificial intelligence and blockchain into treasury software solutions is a key trend shaping the market landscape. These advanced technologies enable automation, real-time analytics, and enhanced risk management capabilities, catering to the evolving needs of treasury management professionals. Market players are focusing on continuous product development and strategic partnerships to drive innovation and market growth, offering comprehensive end-to-end treasury management solutions that cater to various industry verticals, including banking, financial services, retail, healthcare, IT, and telecom.

Moreover, the Asia-Pacific Treasury Software market is experiencing increased consolidation and partnerships among key players to expand their market reach and enhance their competitive positions. These strategic collaborations enable vendors to offer robust encryption technologies and regulatory tools to ensure data security and compliance with global standards. The emphasis on customizable and scalable treasury software solutions that can adapt to diverse organizational needs is also driving market growth. Vendors are providing flexible deployment options, seamless system integration, and advanced reporting capabilities to empower organizations to make informed financial decisions and optimize their cash management processes.

In conclusion, the Asia-Pacific Treasury Software market presents significant opportunities for market players to capitalize on the growing demand for innovative solutions tailored to the unique requirements of businesses in the region. By focusing on continuous innovation, strategic partnerships, and addressing the evolving needs of various industry verticals, vendors can position themselves for sustained success in this dynamic and rapidly evolving market landscape. The market is poised for continued growth as digital transformation reshapes financial processes and organizations increasingly rely on advanced treasury software solutions to drive operational efficiency and strategic decision-making.

Check out detailed stats on company market coverage

https://www.databridgemarketresearch.com/reports/asia-pacific-treasury-software-market/companies

Nucleus is Data Bridge Market Research’s cutting-edge, cloud-based market intelligence platform that empowers organizations to make faster, smarter, data-driven decisions. Designed for strategic thinkers, researchers, and innovators, Nucleus transforms complex macroeconomic indicators, industry-specific trends, and competitive data into actionable insights through dynamic dashboards and real-time analytics. With capabilities spanning market access intelligence, competitive benchmarking, epidemiological analytics, global trade insights, and cross-sector strategy modeling, the platform unifies diverse datasets to help businesses identify opportunities, assess risks, and drive growth across regions and industries. Built on a powerful neural analytics engine, Nucleus bridges the gap between raw data and strategic execution, enabling users to visualize emerging trends, benchmark performance, and make informed decisions with confidence.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/asia-pacific-treasury-software-market

In-Depth Market Research Questions for Asia-Pacific Treasury Software Market Studies

- What revenue figures define the current Asia-Pacific Treasury Software Market?

- What are the near-term and long-term growth rates expected in Asia-Pacific Treasury Software Market?

- What are the dominant segments in the Asia-Pacific Treasury Software Market overview?

- Which companies are covered in the competitor analysis for Asia-Pacific Treasury Software Market?

- What countries are considered major contributors for Asia-Pacific Treasury Software Market?

- Who are the high-growth players in the Asia-Pacific Treasury Software Market?

Browse More Reports:

Global Deep Brain Stimulation Market

Global Plant Based Energy Drink Market

Global Potato Flakes Market

Global Hot Dogs Market

Pakistan, Bangladesh, Sri Lanka, Bhutan and Nepal White Goods Market

Asia-Pacific Synthetic and Biodegradable Marine Lubricants Market

Middle East and Africa Synthetic and Biodegradable Marine Lubricants Market

North America Synthetic and Biodegradable Marine Lubricants Market

Middle East and Africa Snack Pellets Market

North America Self-leveling Concrete Market

Middle East and Africa Release Liner Market

Asia-Pacific Recycled Plastic Market

North America Recycled Plastic Market

Asia-Pacific PVC compound Market

Europe Polyvinyl Chloride (PVC) Compound Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness