Secure Access Service Edge Market Revenue, Share & Forecast | 2035

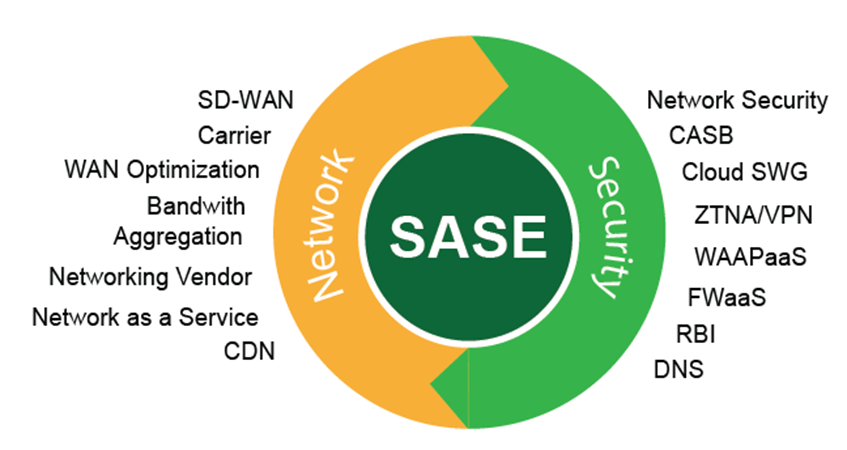

The global cybersecurity and networking industries are being fundamentally reshaped by a continuous stream of strategic Secure Access Services Edge Industry Mergers & Acquisitions, with M&A serving as the primary and most powerful tool for building a comprehensive SASE platform. The SASE architecture is, by definition, a convergence of multiple, previously distinct technology categories. No single company started out with best-in-class technology across all the required components—SD-WAN, SWG, CASB, ZTNA, and FWaaS. Therefore, the race to become a SASE leader has been a race to acquire the missing pieces. This M&A activity is not just about gaining market share; it is a high-stakes, strategic imperative to build a complete, integrated, and competitive platform. The acquisitions are highly targeted, with vendors strategically buying companies to fill specific gaps in their technology stack, to acquire elite engineering talent, and to accelerate their time-to-market with a complete SASE offering. The current market landscape is a direct result of this M&A-fueled platform-building strategy.

The most significant and illustrative M&A trend has been the acquisition of leading SD-WAN companies by major network security vendors. Palo Alto Networks' acquisition of CloudGenix and Fortinet's acquisition of OPAQ are classic examples. These security giants recognized that to deliver on the full SASE vision, they needed to control not only the security stack but also the underlying wide-area networking fabric. Acquiring a leading SD-WAN player instantly gave them this critical networking capability, allowing them to offer a truly integrated, single-vendor SASE solution that could both intelligently route and securely inspect traffic. This move from being a pure security vendor to being a converged networking and security vendor was a transformative step, made possible by M&A. This put immense pressure on other security vendors to follow suit, triggering a domino effect of acquisitions across the industry as everyone scrambled to add the "networking" piece to their security portfolio.

The other major focus of M&A has been on acquiring the key components of the Security Service Edge (SSE) stack. As the market coalesced around the core SSE functions of SWG, CASB, and ZTNA, vendors who were strong in one area moved to acquire companies to fill the gaps in the other areas. For example, a company with a strong SWG offering might acquire a CASB startup to gain the deep data security and SaaS application control capabilities needed to be a credible SSE leader. The acquisition of ZTNA startups has been particularly hot, as ZTNA has become the modern, more secure replacement for traditional VPNs and is a cornerstone of any SASE offering. These technology "tuck-in" acquisitions are all about building a more complete and feature-rich platform. The end goal for all these vendors is to be able to tell their customers that they offer a complete, organically integrated, single-vendor SASE platform, and M&A is the primary and fastest path to being able to make that claim. The Secure Access Services Edge Market size is projected to grow to USD 42.86 Billion by 2035, exhibiting a CAGR of 22.1% during the forecast period 2025-2035.

Top Trending Reports -

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness