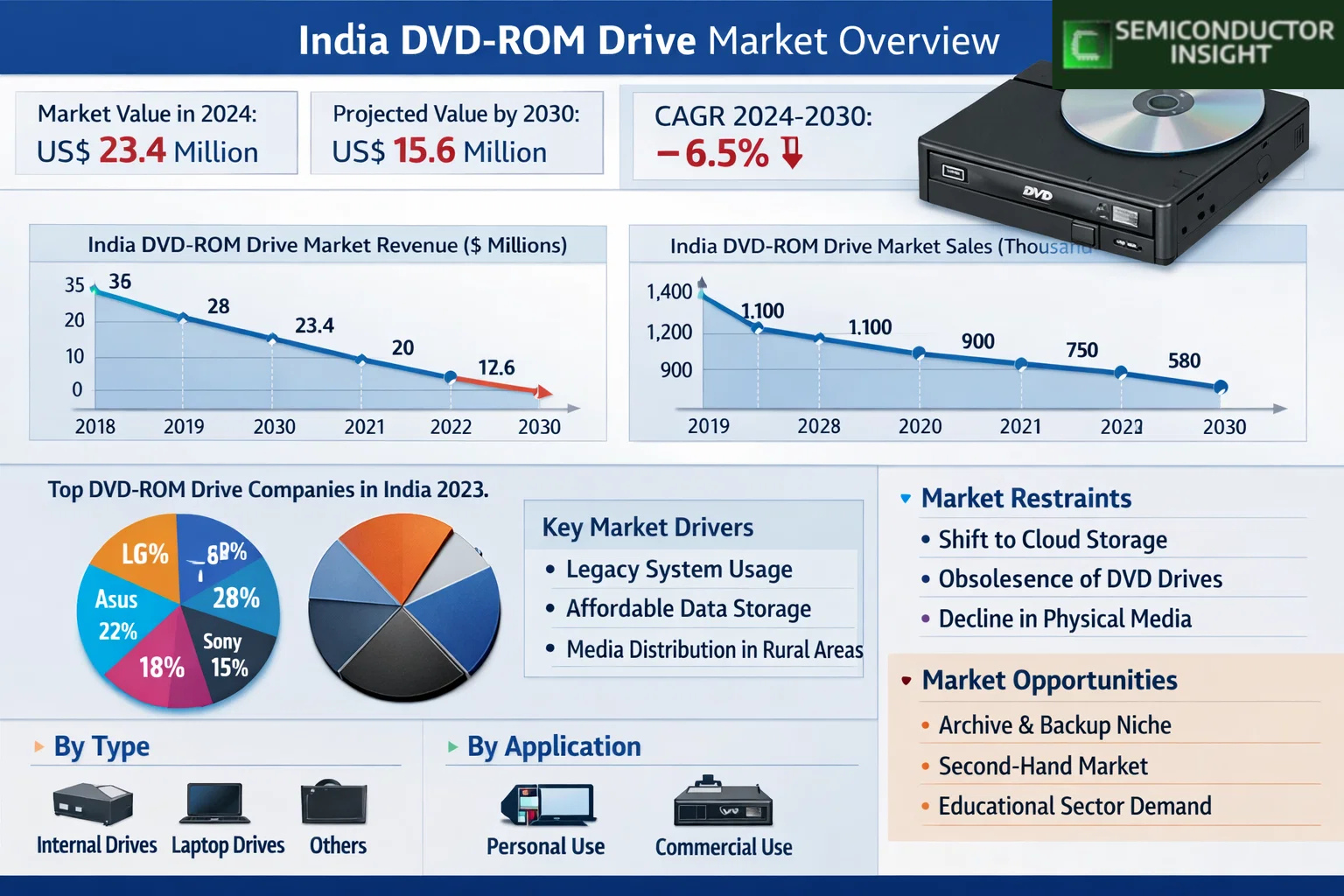

Will India DVD-ROM Drive Market Projected to Decline to USD 15.6 Million by 2034 ..?

India DVD-ROM Drive Market was valued at USD 23.4 million in 2026 and is projected to reach USD 15.6 million by 2034, declining at a CAGR of –6.5% during the forecast period 2026–2034. This contraction reflects accelerating adoption of digital distribution channels, cloud storage solutions, and streaming services that have diminished demand for optical disc drives in both consumer and enterprise segments. Despite steady legacy demand in institutional and low-connectivity sectors, shrinking install bases in PCs and notebooks are key contributors to the ongoing market downturn.

DVD-ROM drives are optical disc drives designed to read DVD media formats, enabling access to software, multimedia, and archived data stored on DVD discs. Once ubiquitous in desktops and laptops, these drives are increasingly absent from newer PC platforms as manufacturers opt for slimmer designs and consumers embrace cloud and USB storage alternatives. The typical use cases for DVD-ROM drives now center on accessing legacy media, archival retrieval, and specific institutional workflows rather than mainstream computing.

👉 Access the complete industry analysis and demand forecasts here:

🔗 https://semiconductorinsight.com/report/india-dvd-rom-drive-market-emerging-trends-technological-advancements-and-business-strategies-2024-2030/

Market Definition and Dynamics

The decline of the India DVD-ROM Drive market is largely attributable to a structural shift in media consumption and storage behavior. Cloud-based file distribution, streaming platforms, and portable solid-state storage have supplanted DVDs as primary delivery mechanisms. Modern laptops and mini-PCs often exclude optical drives to meet consumer preferences for lightweight and compact form factors. As entertainment and software ecosystems move online, physical media sales have dropped precipitously, reducing the need for companion hardware like DVD-ROM drives.

Market Drivers

• Legacy System Dependence: Organizations with large repositories of DVD-based data maintain demand for DVD-ROM drives to access archived content and perform data retrieval.

• Affordable Offline Storage: In regions with limited broadband infrastructure, DVDs provide a cost-effective solution for content delivery without reliance on cloud connectivity.

• Educational Content Distribution: DVD-based instructional media remains relevant in areas with constrained internet access, supporting demand for compatible drives.

Market Restraints

• Cloud and Digital Shift: India’s digital transformation initiatives, including Digital India, have accelerated cloud adoption, reducing reliance on physical media and drives.

• Optical Drive Obsolescence: New PC and laptop designs frequently eliminate optical drives, shrinking OEM and aftermarket opportunities.

• Decline of Physical Media: Streaming platforms and downloadable content have significantly reduced DVD sales, directly impacting DVD-ROM drive utilization.

Market Opportunities

• Archival and Backup Solutions: Sectors requiring offline, secure storage may still leverage DVD media, presenting a sustained niche for DVD-ROM hardware.

• Second-Hand and Refurbished Devices: India’s growing refurbish/resell ecosystem supports replacement and maintenance demand for legacy systems.

• Educational and Remote Use Cases: Targeted offerings for educational institutions and offline content distributors may stabilize niche demand.

Competitive Landscape

The competitive environment for DVD-ROM drives in India includes global hardware brands and OEM partners. Market positioning emphasizes replacement demand, legacy system support, and price competitiveness in refurbished channels.

List of Key DVD-ROM Drive Companies

• Sony India Pvt. Ltd.

• Samsung India Electronics Pvt. Ltd.

• LG Electronics India Pvt. Ltd.

• Toshiba India Pvt. Ltd.

• ASUS India

• Dell India

• HP India Sales Pvt. Ltd.

• Lenovo India Pvt. Ltd.

• Acer India Pvt. Ltd.

• Panasonic India Pvt. Ltd.

These players comprise major global OEMs and consumer electronics brands that have historically supplied optical drive hardware and replacement units for PCs and notebooks. Competitive factors include product reliability, aftermarket support networks, and pricing in the legacy and refurbished segments.

Segment Analysis

By Type

• Internal Drive – Installed in desktop and server systems for legacy data access

• Laptop Drive – External or slim SATA drives for mobile platforms

• Others – Specialty form factors and retrofit devices

By Application

• Personal Use – Home users accessing DVD content

• Commercial Use – Institutional and enterprise archival and software access

The internal and laptop drive segments are declining in parallel with PC shipments that include optical bays. External and specialty retrofit drives comprise a larger share of remaining demand as OEM integration diminishes.

Regional Insights

Demand for DVD-ROM drives varies across India with higher usage concentrated in Tier II/III cities and non-urban regions where internet infrastructure may be limited. Educational institutions and government bodies in smaller states sustain legacy system requirements. Urban centers see accelerated decline corresponding with cloud adoption and laptop replacement cycles.

📄 Download a free sample to explore segment dynamics and competitive positioning:

🔗 https://semiconductorinsight.com/download-sample-report/?product_id=43250

About Semiconductor Insight

Semiconductor Insight is a global intelligence platform delivering data-driven market insights, technology analysis, and competitive intelligence across the semiconductor and advanced electronics ecosystem. Our reports support OEMs, investors, policymakers, and industry leaders in identifying high-growth markets and strategic opportunities shaping the future of electronics.

🌐 https://semiconductorinsight.com/

🔗 LinkedIn: Follow Semiconductor Insight

📞 International Support: +91 8087 99 2013

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness