Aircraft Wheels & Brakes Market Opportunities Emerging from the Expanding Aircraft MRO Industry

Aircraft wheels and brakes are mission critical components that undergo significant wear during every landing, taxi, and braking cycle. Unlike many other aircraft parts, wheels and brakes have relatively short replacement and overhaul intervals due to extreme thermal and mechanical stress. As a result, the aircraft maintenance, repair, and overhaul industry plays a central role in shaping long term demand for these components. The rapid expansion of global MRO capabilities is creating substantial opportunities for the aircraft wheels and brakes market.

Market Context and MRO Driven Demand

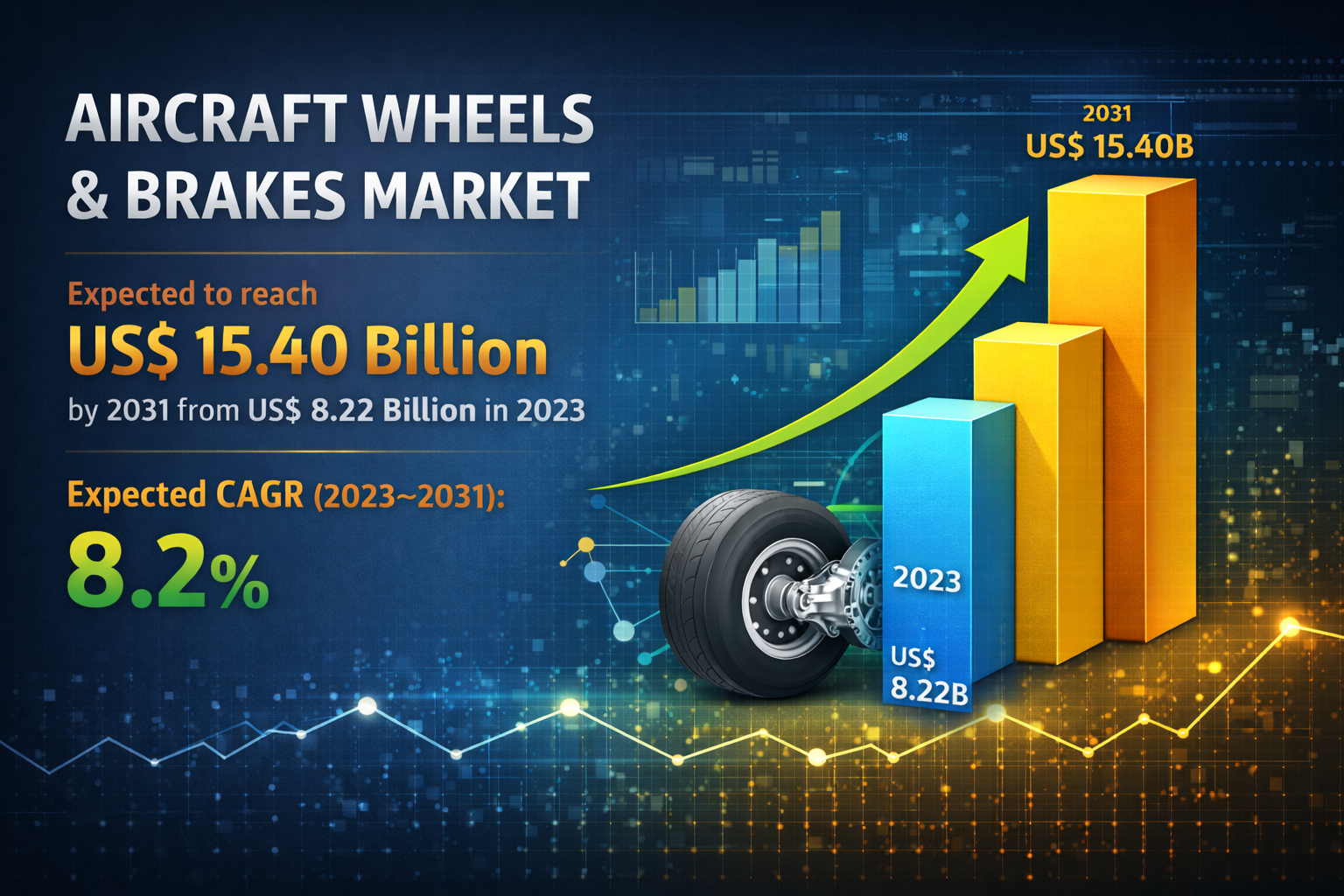

The aircraft wheels and brakes market is witnessing strong expansion, with market size projected to increase from US$ 8.22 billion in 2023 to US$ 15.40 billion by 2031. This growth reflects a robust CAGR of 8.2 percent during the 2023 to 2031 forecast period, driven by rising commercial aircraft deliveries, steady growth in the global aircraft fleet, and increasing demand from the aftermarket and aircraft MRO industry.

Wheels and brakes are replaced or overhauled multiple times during an aircraft’s lifecycle, making them one of the most aftermarket intensive segments in aviation. This recurring demand ensures stable revenue streams for manufacturers and suppliers even during periods of slower aircraft production.

Growth of the Global Aircraft MRO Industry

The global aircraft MRO industry is projected to surpass US$ 140 billion by the mid 2030s, driven by fleet expansion, aging aircraft, and higher utilization rates. Commercial aviation accounts for the largest share of MRO spending, while defense aviation contributes consistent demand through scheduled maintenance and fleet readiness programs.

Emerging economies are playing a major role in this expansion. Asia Pacific, the Middle East, and parts of Latin America are investing heavily in local MRO infrastructure to reduce dependence on overseas maintenance facilities. These regional expansions are creating localized demand for aircraft wheels and brakes, opening new supply and partnership opportunities for manufacturers.

Why does the aircraft MRO industry create strong demand for wheels and brakes?

Wheels and brakes are high wear components that require frequent inspection, replacement, and overhaul. Increased aircraft utilization and aging fleets raise maintenance frequency, directly driving recurring demand from MRO providers.

Opportunities for Wheels and Brakes Manufacturers

The expanding MRO industry is creating multiple growth opportunities across the aircraft wheels and brakes value chain. One major opportunity lies in long term supply agreements with MRO providers. Airlines and MRO operators increasingly prefer predictable maintenance costs and reliable part availability, encouraging strategic partnerships with component manufacturers.

Another opportunity is the growing demand for advanced brake technologies within the aftermarket. Carbon brakes, electric braking systems, and lightweight wheel designs offer longer service life and reduced operating costs. MRO providers are actively adopting these technologies to improve turnaround times and reduce lifecycle costs for airline customers.

Digitalization within MRO operations is also enhancing opportunities. Predictive maintenance tools and health monitoring systems allow operators to anticipate wheel and brake replacements more accurately. Manufacturers that integrate digital support, condition monitoring, and data driven maintenance solutions can differentiate themselves in the aftermarket.

Request PDF Sample Here: https://www.theinsightpartners.com/sample/TIPRE00024462

Regional MRO Expansion and Market Potential

Asia Pacific represents the strongest opportunity region due to rapid fleet growth in China, India, and Southeast Asia. Airlines in these markets are expanding routes aggressively, increasing demand for wheel and brake replacement services. China alone is expected to operate more than 6,000 commercial aircraft by the mid 2030s, significantly increasing local MRO demand.

The Middle East is another high potential region, supported by large widebody fleets and global hub operations. Airlines in this region prioritize high performance braking systems due to frequent long haul operations and high aircraft utilization. North America and Europe remain mature but lucrative markets due to large installed fleets and advanced MRO ecosystems.

Which regions offer the strongest MRO driven opportunities for the wheels and brakes market?

Asia Pacific and the Middle East offer the strongest opportunities due to rapid fleet expansion, rising air traffic, and significant investment in local MRO infrastructure, while North America and Europe continue to provide stable aftermarket demand from large installed fleets.

Competitive Landscape and Strategic Positioning

The aircraft wheels and brakes market remains highly consolidated due to strict certification requirements and safety regulations. Leading players are strengthening their aftermarket presence through global service networks, repair facilities, and partnerships with independent MRO providers. Investment in regional overhaul centers is becoming a key competitive strategy.

Key Players in the Aircraft Wheels & Brakes Market

-

Beringer Aero

-

Collins Aerospace

-

Honeywell International Inc.

-

Meggitt PLC

-

Parker Hannifin Corporation

-

Safran

-

MATCO Manufacturing Inc

-

Grove Aircraft Landing Gear System Inc

These companies are focusing on expanding overhaul capabilities, improving brake durability, and strengthening customer support across high growth MRO regions.

Future Outlook

The expansion of the aircraft MRO industry will remain a defining growth catalyst for the aircraft wheels and brakes market. As fleets grow larger and aircraft operate more intensively, aftermarket demand will continue to outpace original equipment demand in value terms. Manufacturers that invest in advanced brake technologies, regional repair facilities, and long term MRO partnerships will be best positioned to capture these emerging opportunities.

Reported URL

Aircraft Wheel Scanning System Market Size, Share, Scope 2031

https://www.theinsightpartners.com/reports/aircraft-wheel-scanning-system-market

Electric Wheelbarrow Market Size, Share, Scope (2025 - 2031)

https://www.theinsightpartners.com/reports/electric-wheelbarrow-market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness